The depreciation for the next tax year is $333, which is the sum of the following. For a short tax year beginning on the first day of a month or ending on the last day of a month, the tax year consists of the number of months in the tax year. If the short tax year includes part of a month, you generally include the full month in the number of months in the tax year. You determine the midpoint of the tax year by dividing the number of months in the tax year by 2.

- However, depreciation ends once the estimated salvage value of the asset is reached.

- If costs from more than 1 year are carried forward to a subsequent year in which only part of the total carryover can be deducted, you must deduct the costs being carried forward from the earliest year first.

- However, you can claim a section 179 deduction for the cost of the following property.

- The useful life of a patent or copyright is the lesser of the life granted to it by the government or the remaining life when you acquire it.

- Tara is allowed 5 months of depreciation for the short tax year that consists of 10 months.

Which of these is most important for your financial advisor to have?

Land is not depreciable, so Nia includes only the cost of the house when figuring the basis for depreciation. To figure your depreciation deduction, you must determine the basis of your property. To determine basis, you need to know the cost or other basis of your property. If you change your cooperative apartment to business use, figure your allowable depreciation as explained earlier.

Electing the Section 179 Deduction

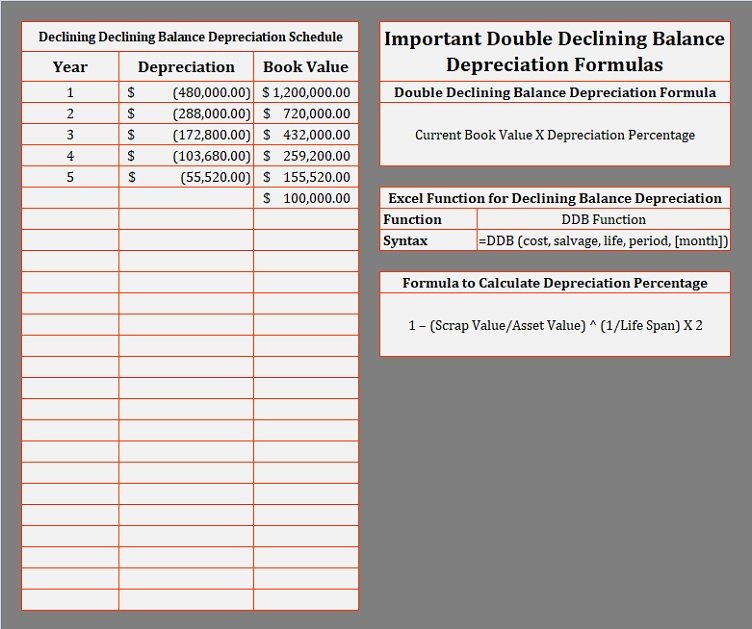

It represents how much of the asset’s value has been used up in any given time period. Sara wants to know the amounts of depreciation expense and asset value she needs to show in her financial statements prepared on 31 December each year if the double-declining method is used. We can incorporate this adjustment using the time factor, which is the number of months the asset is available in an accounting period divided by 12. Another thing to remember while calculating the depreciation expense for the first year is the time factor. The following section explains the step-by-step process for calculating the depreciation expense in the first year, mid-years, and the asset’s final year.

Calculating Depreciation Using the Sum-of-the-Years’ Digits Method

Suppose that trailer technology has changed significantly over the past three years and the company wants to upgrade its trailer to the improved version while selling its old one. It does not matter if the trailer could be sold for $80,000 or $65,000 at this point; on the balance sheet, it is worth $73,000. The two main assumptions built into the depreciation amount are the expected useful life and the salvage value.

Effects of the Declining Balance Method

Double declining balance depreciation allows for higher depreciation expenses in early years and lower expenses as an asset nears the end of its life. An improvement made to listed property that must be capitalized is treated as a new item of depreciable property. The recovery period and method of depreciation that apply to the listed property as a whole also apply to the improvement. For example, if you must depreciate the listed property using the straight line method, you must also depreciate the improvement using the straight line method. Special rules apply to figuring depreciation for property in a GAA for which the use changes during the tax year.

How Is Depreciation Calculated?

If you have a short tax year after the tax year in which you began depreciating property, you must change the way you figure depreciation for that property. If you were using the percentage tables, you can no longer use them. You must figure depreciation for the short tax year and each later tax year as explained next. To determine if you must use the mid-quarter convention, compare the basis of property you place in service in the last 3 months of your tax year to that of property you place in service during the full tax year. If you have a short tax year of 3 months or less, use the mid-quarter convention for all applicable property you place in service during that tax year. You reduce the adjusted basis ($480) by the depreciation claimed in the third year ($192).

Depreciation accounts for decreases in the value of a company’s assets over time. In the United States, accountants must adhere to generally accepted accounting principles (GAAP) in calculating and reporting depreciation on financial statements. GAAP is a set of rules that includes the details, complexities, and legalities of business and corporate accounting.

For example, laptop computers are typically only used for a few years, after which faster laptops become available and the older ones are more likely to be replaced. More commonly, these methods are used to reduce the amount of taxable income in the near term, so that a firm’s tax liability can be pushed out into later periods. Thus, a declining balance method can improve the cash flow of a business by the 6 best small business accounting software 2023 reducing the amount of taxes payable in the short term. Suppose, however, that the company had been using an accelerated depreciation method, such as double-declining balance depreciation. The above example uses the straight-line method of depreciation and not an accelerated depreciation method, which records a larger depreciation expense during the earlier years and a smaller expense in later years.